Thursdays offer a perfect opportunity to pause and reflect on the blessings surrounding us.

Read More

Doctors believe that she may have borderline personality disorde.

Read More

FinanceBuzz announced that it is celebrating the upcoming Star Wars Day.

Read More

An extremely rare blind vole has been spotted and photographed in the Australian outback.

Read More

Are you a dog lover or just looking for some good laughs? Here are some paw-some dog jokes that will brighten your day.

Read More

Anne Hathaway opens up about the "disgusting" chemistry test she went through before starring in romantic movies in the 2000s.

Read More

Whether you believe in ghosts or not, these haunted places in Cardiff, Wales, have an eerie atmosphere and feel of the past.

Read More

Quotes about fall evoke the feeling of wearing cozy sweaters and seeing colorful leaves.

Read More

Here are some of the hottest and most talented female racing drivers that charmed fans both on and off the circuit.

Read More

Matty Healy responded to his ex-Taylor Swift's new album, The Tortured Poets Department.

Read More

Taylor Swift lyrics quotes can remind you to embrace change, be fearless, and never let anyone dull your sparkle.

Read More

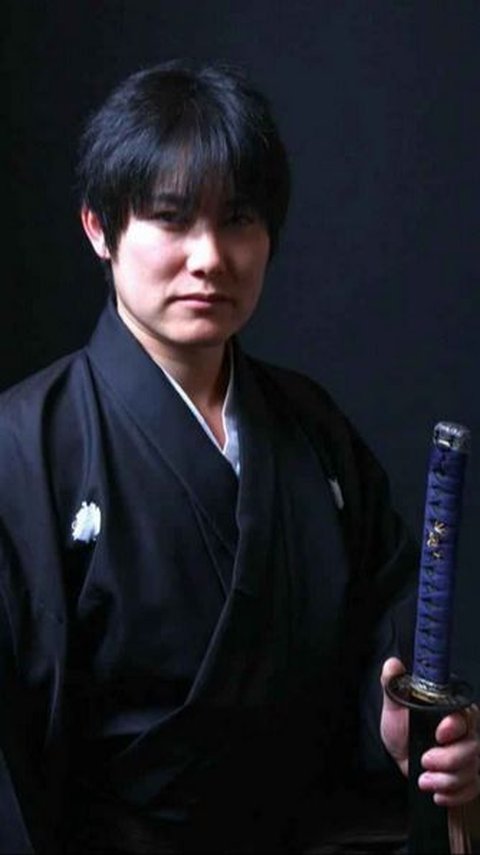

He is the Guinness World Record holder for the most sword slashes in one minute.

Read More

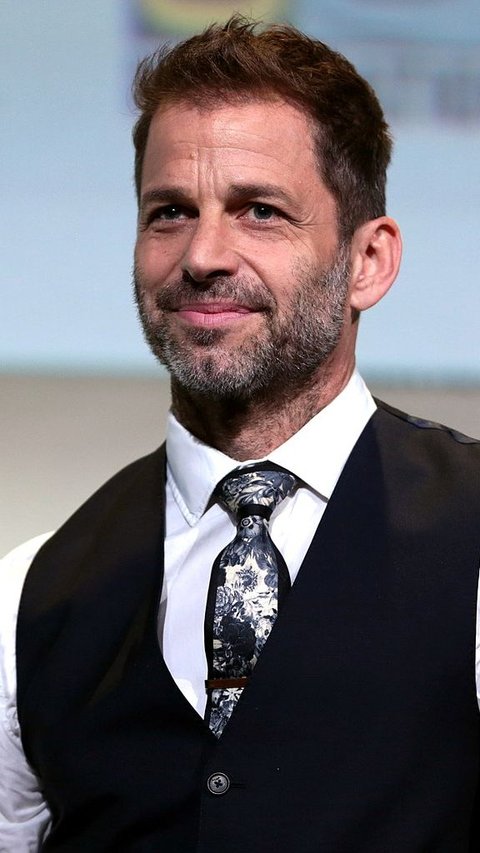

Zack Snyder is an American film director known for his works on comic book movies and superhero films. Here are the top 6 Zack Snyder movies you should watch.

Read More

Ma Dong Seok, also known as Don Lee, is a prolific actor known for his captivating performances, particularly in action films.

Read More

Finding your best soulmate as a Scorpio may need patience and openness, but these five zodiac signs could be your perfect match.

Read More

Here are the best places to visit in August in India for those who want to avoid the crowd during the peak season.

Read More

After winning Miss Buenos Aires, she went viral on Latino social media.

Read More

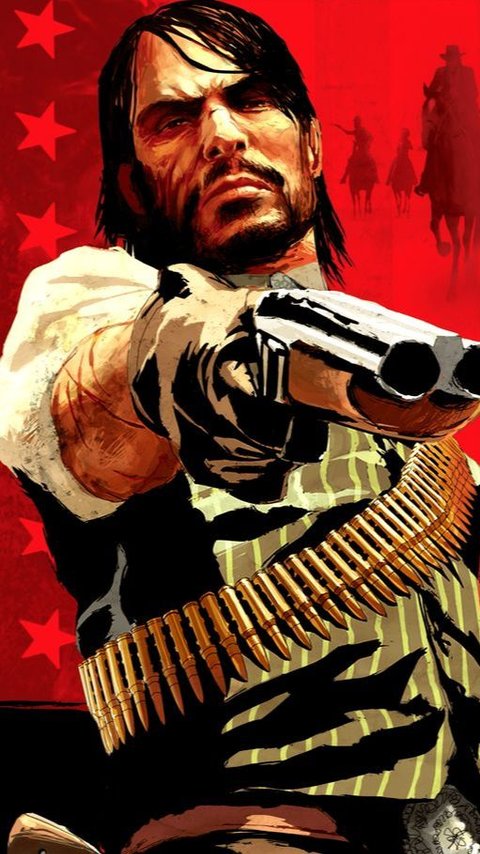

First released in 2006, the PlayStation 3 has several video game titles that have stunning graphics even today.

Read More

Sometimes, simple words can have the most profound meaning.

Read More

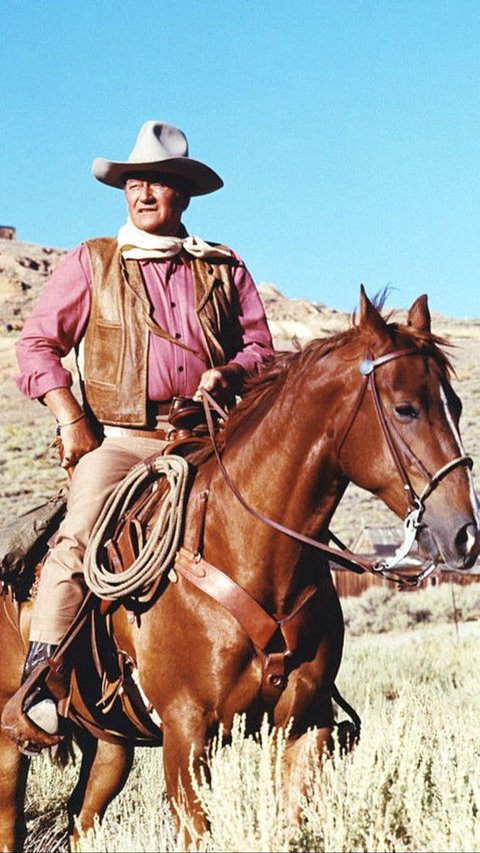

John Wayne movies have stood the test of time and continue to delight audiences of all ages.

Read More

While you are suffering from constipation, you may wonder what helps with constipation. Here are 10 tips and 9 foods to eat that may relieve constipation.

Read More

Our basic biscotti recipe will help you to make this classic Italian delight right on your own kitchen.

Read More

Taylor Swift's beauty tips and skincare routine underline the importance of consistency, hydration, and nutrition.

Read More

These quotes about helping others will inspire you to give a hand to other who need.

Read More

The online bullying was started in December last year.

Read More